utah non food tax rate

91 rows This page lists the various sales use tax rates effective throughout Utah. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Amendments to definitions and provisions relating to the Utah sales and use tax on food and food ingredients become effective January 1 2007.

. The legislation proposes raising the sales tax on food from 175 to 485 but includes an income tax credit of up to 125 per person annually and a decrease in income taxes. Tax years prior to 2008. Back to Utah Sales Tax Handbook Top.

Streamlined Sales Tax Agreement Definition. See the instruction booklets for those years. With local taxes the total sales tax rate is between 6100 and 9050.

TAP will total tax due for you. Utah has state sales tax of 485. Poverty advocates have begged lawmakers not to raise the sales tax on food from its current 175 to 485 arguing this increase would disproportionately fall on low-income people who spend a.

The maximum local tax rate allowed by Utah law is 335. Either the Combined Sales and Use tax rate or the Grocery Food tax rate will apply to all taxable transactions. Both food and food ingredients will be taxed at a reduced rate of 175.

However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. In addition to raising the current 175 state sales on food to the full 485 state rate the proposal would also impose sales taxes on gasoline purchases and on a number of services as first reported earlier this week by the Deseret News. The tax on grocery food is 3 percent.

Utah has a statewide sales tax rate of 485 which has been in place since 1933. Use the Use Tax Rate List below to get the rate for the location where the merchandise was delivered stored used or consumed. State Local Option.

With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more. The list of services subject to sales taxes would include those provided by veterinarians tour guides. January 1 2018 Current.

While the sales tax. Popular Counties All A B C D E F G H I J K L M N O P R S T U V W. Grocery food does not include alcoholic beverages tobacco or prepared food.

Non-food and prepared food sales. If you have grocery food sales report total tax for grocery food. Utah has recent rate changes Thu Jul 01 2021.

Grocery food is food sold for ingestion or chewing by humans and consumed for taste or. Tax calculation grocery food sales. Restoring the current 3 state sales tax on food to the full 485 state sales tax rate was not part of last sessions bill but had support in the Senate.

Utah has a higher state sales tax than 538 of states. SALES TAX ON FOOD PURCHASES State Sales Tax Rate Income Tax RateGrocery Tax Credit Residency Requirement Income Qualifications Other Qualifications Refundable Fiscal Impact HI 4 140 - 1100 35-110 per qualified exemption Present in HI for more than 9 months of the year Less than 30000 for single or married filing separately. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Enter the amount of sales here.

GR The general state sales and use tax rate LR A lower sales and use tax rate imposed on food E Exempt -- No sales and use tax imposed. While food and food ingredients remain subject to county and local taxes the state sales and use tax rate is reduced from 475 to 275. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here.

California 1 Utah 125 and Virginia 1. Average Sales Tax With Local. Municipal governments in Utah are also allowed to collect a local-option sales tax that ranges from 125 to 42 across the state with an average local tax of 211 for a total of 696 when combined with the state sales tax.

The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Bakery items as well as food and food ingredients sold by a. Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah.

Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 211 on top of the state tax. January 1 2008 December 31 2017. Utah has an income tax credit equal to 6 of the current federal personal exemption as an applicable standard deduction.

Would add 250 million in new revenue. Food and food ingredients does not include an alcoholic beverage tobacco or prepared food. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Only one rate will apply to a single transaction. 31 rows Utah UT Sales Tax Rates by City. B Three states levy mandatory statewide local add-on sales taxes.

In the state of Utah the foods are subject to local taxes. The rates under Transient Room Prepared Food and Short Term Leasing include the applicable Combined Sales and Use tax rate. Utah has a single tax rate for all income levels as follows.

Monday the task force was told eliminating the reductions made more than a decade ago under former Gov. For example the rate of 1282 applies. If a locality within a county is not listed with a separate rate use the county rate.

Select the Utah city from the list of popular cities below to see its current sales tax rate. Sales and use tax rates vary throughout Utah. We include these in their state sales tax.

The state sales tax rate in Utah is 4850. There are -739 days left until Tax Day on April 16th 2020.

States With Highest And Lowest Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

States Without Sales Tax Article

States Without Sales Tax Article

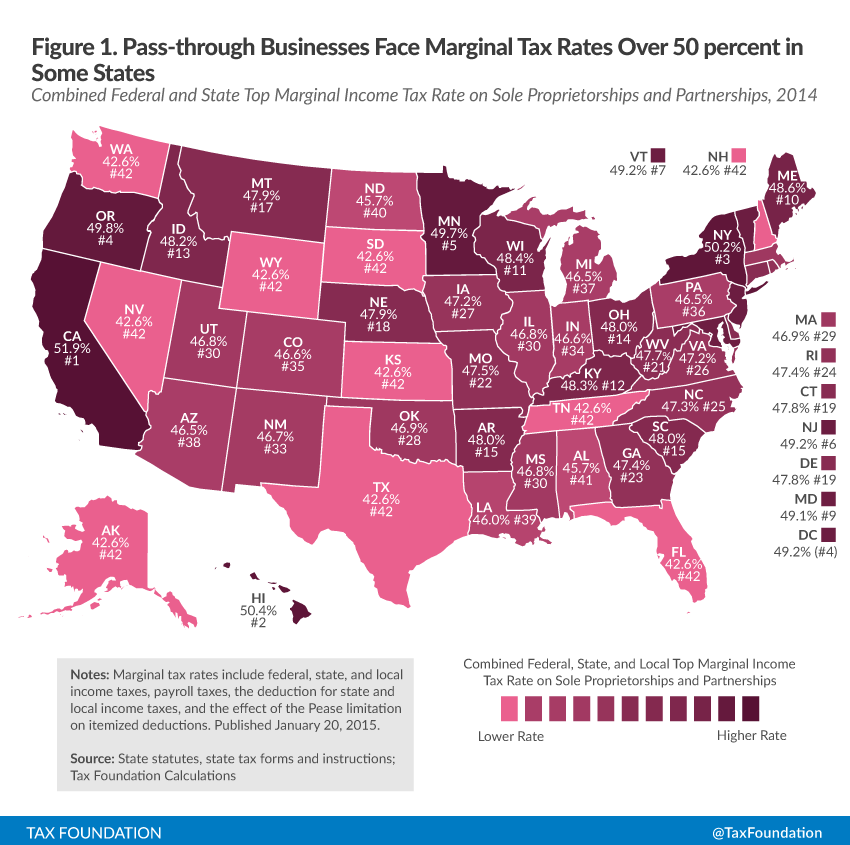

An Overview Of Pass Through Businesses In The United States Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Taxes In The United States Wikiwand

States Without Sales Tax Article

Sales Tax On Grocery Items Taxjar

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

Utah Sales Tax Small Business Guide Truic

State And Local Sales Taxes In 2012 Tax Foundation

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)